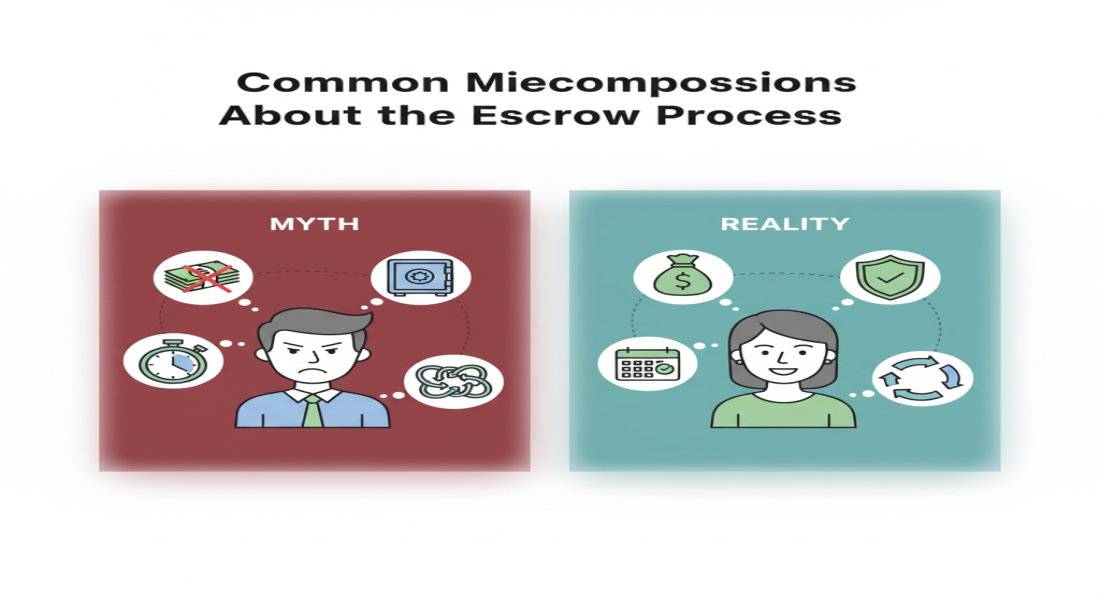

Common Misconceptions About the Escrow Process

Escrow is a well-established financial mechanism, yet it's often surrounded by misunderstandings. These misconceptions can lead to confusion, frustration, or even missed opportunities for a smoother transaction. Let's clear up some of the most common myths about escrow to help you navigate your next big purchase or sale with greater clarity.

One common myth is that escrow automatically protects against all risks; while it significantly reduces risk, it doesn't cover issues outside the agreed-upon conditions (like future market value changes). Another is that the escrow officer makes decisions in disputes; in reality, they are neutral and facilitate, not arbitrate. Some also believe escrow always speeds things up, when in fact, it ensures all steps are completed correctly, which can take time. Understanding that escrow is about structured security, not magical protection or instant speed, is key.